The world of finance is abuzz with the story of Altahawi, a visionary entrepreneur who has launched an exciting journey to list his company on the prestigious Nasdaq and NYSE stock exchanges. Altahawi's meticulous plan involves utilizing the powerful tool of a Reg A+ offering, an avenue for raising capital by selling securities directly to the public. This mechanism grants significant benefits , allowing Altahawi's company to access a broader pool of financers.

The A+ Regulation is a crucial phase in Altahawi's ambitious plan to take his company further . It poses a unique situation for Altahawi and his team, necessitating rigorous preparation and execution.

- Andy Altahwai's company has assembled a skilled team of experts to navigate the complex process of a Reg A+ offering.

- This team is working tirelessly to ensure strict fulfillment of all regulatory requirements and achieve a positive outcome for listing on both the Nasdaq and NYSE.

- Potential shareholders in being part of this exciting journey can delve into Altahawi's company and the Reg A+ offering through official channels .

Charting Reg A+ Altahawi's Path to Public Markets

Altahawi's voyage to becoming a publicly traded company has been marked by strategic decisions . The firm, aiming for public market listing through the Reg A+ mechanism, has embraced this distinctive route to access capital and amplify its profile.

- Crucial for Altahawi's success has been a thorough understanding of the Reg A+ guidelines . This includes navigating the intricate processes involved in filing, disclosure and investor communication.

- Moreover, Altahawi has built strong relationships with key players within the capital markets landscape. These alliances have been vital in providing guidance and assistance throughout their Reg A+ pursuit .

In the end, Altahawi's deliberate approach to navigating the Reg A+ path has set the stage for its triumphant entrance into the public markets. Their story serves as a insightful case study for other companies evaluating a similar trajectory .

Altahawi's Innovative Approach : Leveraging Reg A+ for NASDAQ or NYSE Success?

Can Andy Altahawi, renowned entrepreneur, navigate the intricacies of Reg A+ to achieve his ambitious goals of a listing on either the prestigious NASDAQ or the venerable NYSE? Altahawi's company, Altahawi Enterprises, has been experiencing exponential growth in recent years. A Reg A+ offering could provide the crucial capital infusion needed to propel Altahawi's ventures onto a global arena. The success of this strategy, however, hinges on several factors.

- Strategic planning and research

- An innovative value proposition

- Securing support from influential stakeholders

The path to a NASDAQ or NYSE listing is never easy. Only time will tell if Andy Altahawi can successfully leverage Reg A+ to unlock the next chapter in his entrepreneurial saga.

Regulation A+ in Altahawi's NYSE/NASDAQ Aspirations

Altahawi Group is strategically considering a listing on the prestigious NYSE or NASDAQ stock exchanges. This ambitious goal would provide significant benefits to the company, driving access to a wider pool of investors and boosting its public profile. Reg A+, a relatively new avenue for companies to raise capital through public offerings, has emerged as a potential tool in Altahawi's arsenal.

By utilizing Reg A+, Altahawi could effectively generate the essential funds to support its expansion. The regulatory framework surrounding Reg A+ offers a streamlined process compared to traditional IPOs, making it an attractive choice for companies like Altahawi that are seeking a swift path to public markets.

The successful implementation of Reg A+ could serve as a springboard for Altahawi's get more info NYSE or NASDAQ listing, launching it on a trajectory of sustained growth and recognition within the global financial community.

Altahawi's Pursuit of Nasdaq & NYSE Listing Through Reg A+

Altahawi has embarked on a strategic pathway to achieve a coveted listing on prominent stock exchanges such as the Nasdaq and NYSE. Leveraging the innovative framework of Regulation A+, Altahawi strives to raise capital while simultaneously increasing its public profile. Reg A+ presents a unique platform for companies like Altahawi to tap into the broader investor community, driving growth and expansion.{

This decision signifies Altahawi's commitment to transparency and openness, highlighting its confidence in the future. By adhering to the stringent requirements of Reg A+, Altahawi intends to establish itself as a trusted player in the investment landscape.

Reg A+: Unlocking the Potential for Altahawi on NASDAQ and NYSE within

Altahawi stands at a pivotal juncture, poised to capitalize significantly on the burgeoning opportunities presented by the capital markets. Through a strategic Reg A+ offering, the company aims to propel its growth trajectory and unlock access to a wider pool of investors. Listing in prestigious exchanges like NASDAQ and NYSE would grant Altahawi unmatched visibility and credibility within the global financial landscape. This strategic move may transform Altahawi into a market leader, fueling its expansion horizons.

By leveraging the thriving ecosystem of these prominent exchanges, Altahawi can attract significant capital investment that would fuel its research and development efforts, strategic acquisitions, and global expansion. Reg A+ offers a streamlined and efficient path for companies like Altahawi to conquer the complexities of public listing, providing them with an platform to achieve their full potential.

Macaulay Culkin Then & Now!

Macaulay Culkin Then & Now! Nancy McKeon Then & Now!

Nancy McKeon Then & Now! Bill Cosby Then & Now!

Bill Cosby Then & Now! Bernadette Peters Then & Now!

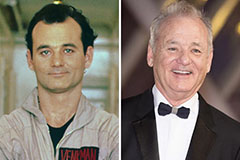

Bernadette Peters Then & Now! Bill Murray Then & Now!

Bill Murray Then & Now!